LIVERMORE LIVING

Welcome to your Livermore, CA Community Page!

Get full-access to everything Livermore! Find out lots of great information about the city, including the latest market updates, buyer and seller tips, and the "best" the city has to offer.

CLICK A LINK BELOW TO BE TAKEN TO THE SECTION

Relocating To Livermore? Learn how to get $3,000+ towards your closing costs! Watch this short video to learn how!

Livermore Overview

Nestled in the heart of California's Wine Country, Livermore invites you to a city where vineyards, science, and community spirit harmoniously coexist. As you contemplate relocating, this guide provides insights into Livermore's unique charm, offering a glimpse into a community that seamlessly blends tradition and innovation.

Weather:

Livermore boasts a Mediterranean climate with warm, dry summers and mild, wet winters. With approximately 260 sunny days per year, residents can bask in the California sunshine, creating an ideal environment for year-round outdoor activities and exploration.

Cost of Living:

Livermore offers a moderate cost of living, providing residents with a balance between small-town charm and modern comforts. Housing costs, everyday expenses, and access to amenities align to create an environment that caters to a variety of budgets.

Safety:

Safety is a priority in Livermore, with the city's commitment to maintaining a secure environment for its residents. Proactive community policing, neighborhood watch programs, and community engagement contribute to Livermore's reputation as a safe place to call home.

Employment:

Livermore's economic landscape is diverse, offering employment opportunities in sectors such as technology, research, and winemaking. The city's strategic location within the Bay Area ensures access to a range of job opportunities and career growth.

Education:

Education is valued in Livermore, with schools like Livermore High School exemplifying academic excellence. Families moving to Livermore can trust in the city's dedication to providing quality education for their children, fostering an environment conducive to scholastic achievement.

College and Junior Colleges Nearby:

For those pursuing higher education, Livermore is situated near esteemed colleges and junior colleges. Institutions like Las Positas College offer convenient options for advancing education, enhancing Livermore's appeal as an education hub.

Cultural Interests:

Livermore's cultural scene is rich, with venues like the Bankhead Theater hosting performances and events. The city's historical downtown district, wineries, and cultural festivals contribute to Livermore's unique cultural identity.

Dining and Entertainment:

Livermore's culinary landscape caters to diverse tastes, with local favorites like The Restaurant at Wente Vineyards and entertainment venues ensuring lively evenings. The downtown area and winery districts offer a variety of options for dining and entertainment.

Kids Activities:

Livermore is family-friendly, offering an array of kid-centric activities. Parks, community events, and educational programs create an environment where children can thrive and families can build lasting memories.

Outdoor Activities:

Surrounded by the scenic beauty of Wine Country, Livermore invites residents to embrace outdoor living. Parks, hiking trails, and vineyard tours provide opportunities for nature enthusiasts to immerse themselves in the city's picturesque landscapes.

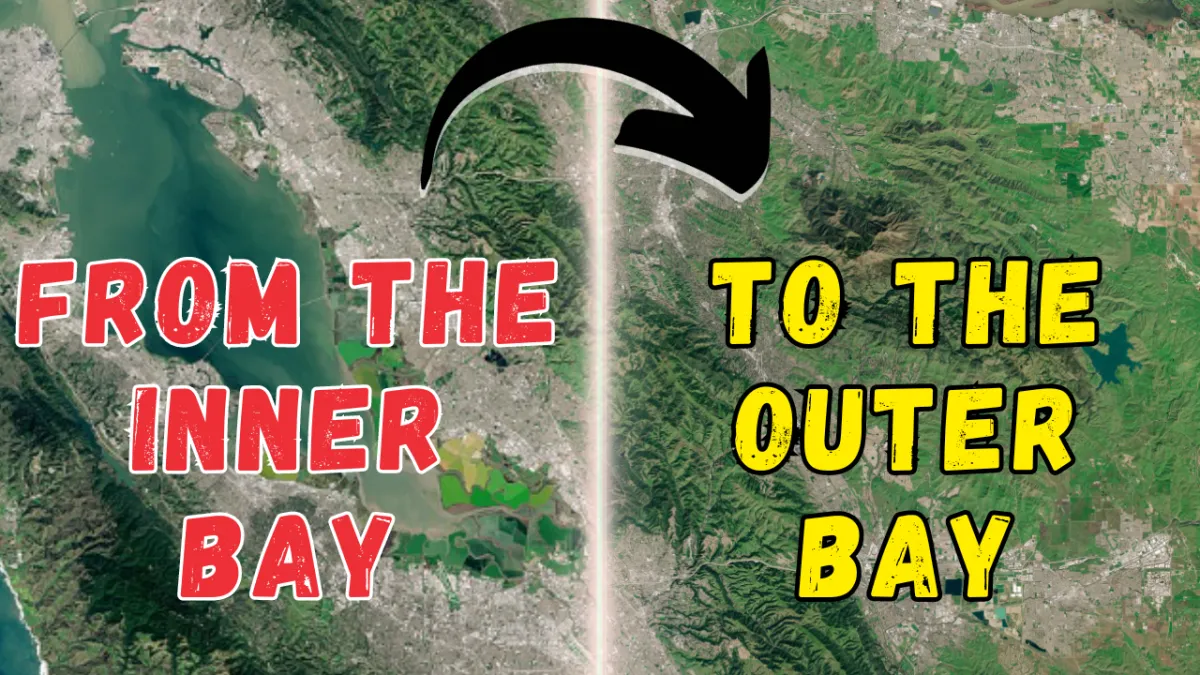

Commuting:

Livermore offers efficient commuting options, with access to major highways and well-maintained roads. The Altamont Corridor Express (ACE) train provides convenient transit options for residents commuting to neighboring cities.

Community Events:

Livermore thrives on community engagement, with events like the Livermore Wine Country Festival and the Livermore Rodeo Parade bringing residents together. These events contribute to the city's close-knit community spirit.

Relocating Info To Know

Livermore Market Update

Commute Concerns? Watch This!

Can You Afford To Buy A Home?

First-Time Homebuyers Guide

Homebuyer Assistance

New Construction Tips

Mortgage Calculator

Interest Rates

New Construction In The Area

Got Questions? Scan my information or call me!

All About Livermore

video

video

MORE TO COME!

MORE TO COME!

MORE TO COME!

MORE TO COME!

Livermore Home Values Over Time (Jan. 2024)

Now

$1,078,000

1 Year Ago

$1,029,000

Currently up 4.7% from a year ago

5 Years Ago

$800,000

Currently up 135% from 5 years ago

Livermore Population and Livability

Population

89,928

Livability Score

65 out of 100

Livermore Education

Elementary Schools:

Best Ranked:

2nd Best:

Middle Schools:

Best Ranked:

2nd Best:

High Schools:

Best Ranked:

2nd Best:

Junior Colleges Near Livermore

Colleges Near Livermore

Livermore Info That's Good To Know

Annual Community Events

Highlights

Pet Friendly

Popular Places

Popular With Kids

Kids Sports

WHY I'M YOUR GUY!

WANT A BONUS $500 AT CLOSING?

SIMPLY TEXT "YOU'RE MY GUY" TO 209-771-2199!

The "Best" in Livermore

Best Burgers

Best Mexican

Best Steaks

Best Japanese/Sushi

Best Vietnamese

Best Indian

Best Breakfast & Lunch

Best Chinese

Best Sandwiches

Best Donuts

Best Thai

Best Pizza

Best Barbecue

Best Hawaiian

Best Italian (non-pizza)

Best Cafes

Best Honorable Mentions

Best Cocktails

Best Sports Bars

Best Wine Bars Nearby

Best Coffee Shops

Best HVAC

Best Flooring

Best Plumbers

Best Day Spas

Best Dentists

Best Massage Therapists

Best Gyms

Best Eye Doctors

Best Physical Therapists

Best Chiropractors

Outside Livermore

Best Golfing

Best Camping

Best Unique Activities

Stats Of Cities Around Livermore (Jan. 2024)

Pleasanton

Ave. Home Value: $1,565,000

Population: 72,685

Livability Score: 84 out of 100

Dublin

Ave. Home Value: $1,297,000

Population: 71,750

Livability Score: 84 out of 100

San Ramon

Ave. Home Value: $1,534,000

Population: 87,787

Livability Score: 83 out of 100

Ready to discuss your future move? Let's talk! Book an appointment, or reach out to me directly at 209-771-2199.

Buyer Info, Tips & Tools

7 Mistakes When Buying

11 Buyer Tips To Know

7 Pre-Approval Mistakes

New Home Pros and Cons

New Home Obstacles

new construction

My Tasks As Your Agent

Who Pays What At Closing?

Use My Moving Concierge

Ready To Get Pre-Approved?

Fill out the form and I will have my preferred lender reach out to you within 24 hours.

Get My Ultimate Relocators' Buying Guide!

Get access to your Ultimate Relocation Homebuyer's Checklist Guide!

Top 12 Buyer FAQ's

What’s the initial step in purchasing a home?

The first step in purchasing a home is to get pre-approved. Meet with a lender, mortgage broker or bank to discuss your income, debts, and assets for pre-approval. After reviewing your information, the lender will tell you how much they can lend and at what interest rate.

Get pre-approved also shows sellers you're serious. Sometimes a pre-approval is required to view expensive residence, but it also speeds up the offer process once you select a home.

What are my options if my offer is turned down?

If your house offer is rejected, here are 3 immediate actions that can be taken:

Increase your offer: If the seller rejected your offer because it was too cheap, consider boosting it.

Ask for a counteroffer: The seller may reject your offer, but still be willing to negotiate by offering an alternative. This lets you change your offer or negotiate closing date or repairs.

Keep looking: If the seller won't negotiate and you won't raise your offer, you can look elsewhere.

How does my agent get paid when buying a house?

Real estate agents receive a commission from sellers, usually a percentage of the sale price. The seller and buyer share the commission negotiated by the seller before listing the home.

Best part? Most buyers don't pay their agent directly. However, the commission is included in the home's sale price.

What is a buyer’s market?

Buyers' markets are opposite sellers' markets. Supply over demand creates a buyer's market, providing buyers a negotiating advantage. More than a 7-month supply indicates a buyer's market and property value decline.

Common buyer's market causes:

-Lots of homes for sale

-Recessionary economy

-High mortgage or interest rates

-Mortgage approval issues or tighter lending constraints

-New home construction overexposure

What is a seller’s market?

In a seller's market, inventory is fewer than 5-6 months, hence prices rise. The low availability of properties on the market keeps housing prices rising.

Common seller's market causes:

-Home inventory shortages

-Economic growth and job creation

-Low mortgage or interest rates

-Reduced lending regulations or simpler mortgage financing

-Slower new construction homebuilding

What does "Days on Market" (DOM) mean?

The "Days on Market" is the number of days a property has been listed on the local multiple listing service. It starts the day the home is listed and will accumulate until the seller has accepted an offer and signed a contract.

Knowing the DOM for a home is critical to your negotiating power. Why? Because the number of days a home spends on the market directly affects the price of a home. This information can be used to the buyer’s benefit to negotiate a lower price.

What does "contingent" mean when selling a home?

Contingent means that one thing must happen before another. Real estate deals fall through if the seller or buyer don't meet specified standards. Contingencies, or contract “clauses,” safeguard any party from not obtaining funds, an inspection, or a variety of other possible situations that may arise,

What does "appraisal" mean when buying?

Your home's value is estimated by an appraisal. The appraisal is completed by an appraiser who gives the lender or bank confidence that the property is worth a given amount. After the buyer and seller agree on the price, an appraiser performs a home appraisal to make sure the loan is justified and supported by the value of the home.

What does "fair market value" mean?

The fair market value is the price a buyer will pay and the seller will accept. Homes don't always sell for fair value.

If a buyer really wants a property or a bidding war breaks out, a buyer may offer more than the list price or fair market value.

What is an earnest money deposit?

After agreeing on pricing, the seller collects earnest money from the buyer and this money is called the earnest money deposit. This ensures that the buyer is sincere and not just negotiating deals with other house sellers.

Earnest money typically ranges from 1-3% of the sales price depending on the market. The buyer will get their earnest money back if the seller backs out. The buyer will lose their earnest money if they back out under certain conditions.

The earnest money deposit will go towards the closing costs the buyer is responsible for.

What's the difference between the list price and the sale price?

A list price is how much the seller lists the home for, which is also referred to as their “asking price.” The sale price is the amount of money the home actually sells for.

What is title insurance?

Title insurance protects homeowners from allegations made by previous owners, such as unpaid taxes or unfair contractor compensation. Title insurance covers legal bills and title disputes during your homeownership.

Two types of title insurance exist:

Selling a home normally requires lender title insurance. The lender is protected from housing claims with this type.

Owner title insurance is optional, but paying this one-time price will protect you from title issues for as long as you own the home.

Homes For Sale Right Now!

Considering Other Areas? Check Out These Community Pages!

Ave. Home Value:

$797,000

Population: 65,995

Livability Score:

62 out of 100

Ave. Home Value:

$1,565,000

Population: 72,685

Livability Score:

84 out of 100

Ave. Home Value:

$1,076,000

Population: 68,864

Livability Score:

75 out of 100

Ave. Home Value:

$744,000

Population: 120,826

Livability Score:

68 out of 100

Seller Info, Tips & Tools

11 Curb Appeal Ideas

Common Seller Mistakes

Negotiation Strategies

My Tasks As Your Listing Agent

Who Pays What At Closing?

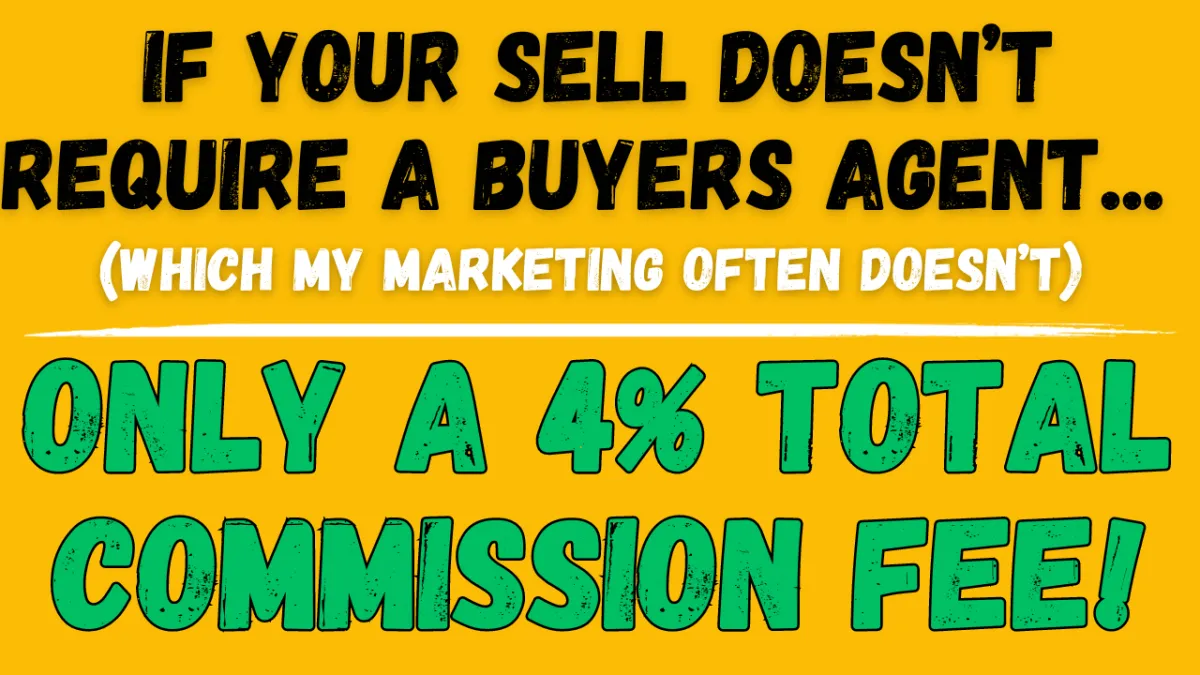

"List With Me" Benefits for Sellers

Curious what my marketing plan to sell your home looks like? Get access to it here?

My Seller's Marketing Plan will get your home sold quickly for top dollar, check it out!

What's Your Home Worth? (2 OPTIONS)

OPTION 1: Considering A Move Soon? Watch This Video On How To Get A Home Analysis

OPTION 2: Curious About A Monthly Home Report Card? Get A Homebot FREE!

Top 12 Seller FAQ's

How do I know when it's time to sell?

The primary reason for selling is when the market is thriving. With that being said, there are other reasons for considering selling. For instance, your family has outgrown your home and you're ready to downsize. You're also at a point where you don't want to deal with maintenance and you're emotionally prepared to deal with the selling process.

How much is my house worth?

Location, size and layout, condition, features, and market conditions (supply and demand) all play a role in determining a home's worth.

An agent can perform a Competitive Market Analysis (CMA) to evaluate a home's value.

How long do you think it will take to sell my house?

This answer varies on demand, house qualities, local market conditions, interest rates, among other considerations.

Timelines can be as quickly as a couple of weeks, up to 6 months. Properties usually average between 2-3 months under typical market conditions. The median number of days property listings spend on the market is from list date to closing.

Should I have a home inspection done before listing my house?

Yes! Before listing a house, a home inspection is a good idea.

A home inspection reveals your home's condition and prospective issues. Always be proactive and consider important repairs and maintenance before selling your home to ensure your house is in good shape and that you won't be startled by future repairs.

What are some things I need to do to get my house ready for sale?

From major repairs to staging, preparing a home for sale is essential to selling it.

Clutter and personal objects are usually removed first. If you have lots of stuff, you may require a storage facility. Remember that potential buyers want to visualize their belongings in the house, so make it as neutral as possible.

A deep clean, neutralizing decor, removing pet signs, improving curb appeal, and staging the home to highlight its strengths are other measures.

What is a buyer’s market?

Buyers' markets are opposite sellers' markets. Supply over demand creates a buyer's market, providing buyers a negotiating advantage. More than a 7-month supply indicates a buyer's market and property value decline.

Common buyer's market causes:

-Lots of homes for sale

-Recessionary economy

-High mortgage or interest rates

-Mortgage approval issues or tighter lending constraints

-New home construction overexposure

What is a seller’s market?

In a seller's market, inventory is fewer than 5-6 months, hence prices rise. The low availability of properties on the market keeps housing prices rising.

Common seller's market causes:

-Home inventory shortages

-Economic growth and job creation

-Low mortgage or interest rates

-Reduced lending regulations or simpler mortgage financing

-Slower new construction homebuilding

What does "Days on Market" (DOM) mean?

The "Days on Market" is the number of days a property has been listed on the local multiple listing service. It starts the day the home is listed and will accumulate until the seller has accepted an offer and signed a contract.

Knowing the DOM for a home is critical to your negotiating power. Why? Because the number of days a home spends on the market directly affects the price of a home. This information can be used to the buyer’s benefit to negotiate a lower price.

What does "contingent" mean when selling a home?

Contingent means that one thing must happen before another. Real estate deals fall through if the seller or buyer don't meet specified standards. Contingencies, or contract “clauses,” safeguard any party from not obtaining funds, an inspection, or a variety of other possible situations that may arise,

What does "appraisal" mean when selling?

Your home's value is estimated by an appraisal. The appraisal is completed by an appraiser who gives the lender or bank confidence that the property is worth a given amount. After the buyer and seller agree on the price, an appraiser performs a home appraisal to make sure the loan is justified and supported by the value of the home.

What is a title search?

Title companies conduct title searches to inform buyers and lenders that the seller is the rightful property owner and can sell the property.

Title searches examine the home's history and owner to find liens and easements. A lien is a hold on the property to secure payment for IRS taxes, refinanced mortgages, federal mortgage aid programs, contractor liens, etc. Most of these concerns are resolved when the home sells and the liens are paid off or erased.

How much of the sale price do I actually get?

Selling your property often yields 90–92% of the sale price, depending on many conditions. Most include 5–6% realtor commissions and 2–4% taxes and fees. If you owe on an old mortgage, that'll be taken out as well.

Your closing agent will disperse monies to all parties on closing day. Your gains are paid by check or wire transfer.

Got Questions? Scan my information or call me!

5 Interesting Facts About Livermore

Livermore is...

--

--

--

--

--

What Our Clients Say...

Andre is truly the best real estate agent I've met and an all-around fantastic person! After meeting many agents over the past year, it was a breath of fresh air to have someone who is truly on your side. It seems like every other agent just says "yes" to anything and doesn't actually listen to you. Andre always provides an honest opinion and helped us out in the following ways:

-Extremely attentive. His attention to detail was outstanding and noticed many faults with the listing that I would not have noticed. He helped us choose the best home by ensuring there were no major faults in the property we were selecting.

-Always available. Andre was always willing to make time for us and was willing to speak with us at any time of the day. A purchase this large comes with stress that can only be relieved when your questions are answered.

-Industry experience. His experience allowed him to quickly understand other selling agents and know when they were not willing to offer us a fair deal.

-Excellent negotiating skills. He was able to get us an excellent deal on a property that was thoroughly reviewed by both ourselves and Andre. Not only were we confident that he helped us select the property in the best condition, but we knew he negotiated the best price for us.

I would highly recommend allowing Andre to help you out. He is not like the rest, and really does make you feel like he's on your side.Thanks for your help Andre :)

Nick M.

Andre was so attentive to my needs in this transaction. He kept me apprised of what was going on every step of the way. Andre helped me to get a great deal on the property. He listened to my concerns and addressed them every step of the way. I highly recommend Andre to anyone who's in the market for a new home.

Laura S.

I can’t speak highly enough about Andre. After working with him I can tell why he had been referred to me. He was patient with us every step of the way despite the delays on our end. The entire process was seamless and as efficient as they come. Andre's communication was top notch in keeping us in the loop and was always available and responsive for our questions. He negotiated a great deal for us and I can’t recommend him enough.

Jennifer S.

Ready to discuss your future move? Let's talk! Book an appointment, or reach out to me directly at 209-771-2199.